How an Offshore Tax Accountant Can Transform Your Accounting Operations

In today’s fast-paced business environment, accounting operations are becoming increasingly complex. Firms and businesses face tight deadlines, evolving tax regulations, cross-border compliance challenges, and the constant pressure to deliver accurate financial reporting. For many, managing these demands with in-house teams alone is no longer sustainable. This is where outsourcing to skilled professionals comes in — and specifically, choosing to hire offshore tax accountant can transform the way your accounting operations function.

Understanding the Role of an Offshore Tax Accountant

An offshore tax accountant is a qualified professional located outside your country who handles tax preparation, compliance, reporting, and advisory tasks for your business or firm. Unlike traditional outsourcing, offshore tax accountants often integrate fully with your team, following your firm’s processes and quality standards. Their role may include:

-

Preparing individual, corporate, or partnership tax returns

-

Managing cross-border compliance requirements

-

Conducting tax reconciliations and book-to-tax adjustments

-

Handling supporting documentation and filings

-

Advising on international tax planning strategies

The ability to scale operations while maintaining accuracy makes hiring an offshore tax accountant a strategic move for businesses and CPA firms alike.

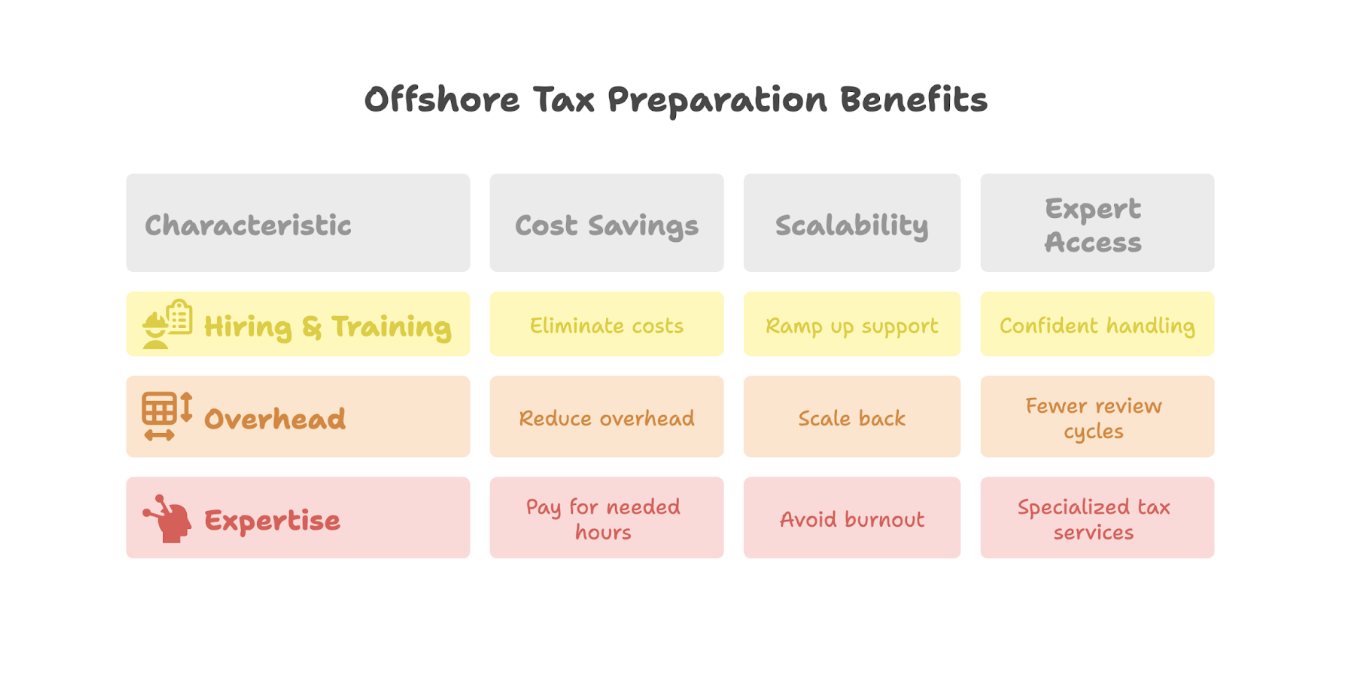

Key Benefits of Hiring an Offshore Tax Accountant

1. Improved Accuracy and Compliance

Errors in tax filing or financial reporting can be costly, leading to penalties, audits, or reputational damage. Offshore tax accountants are often highly specialized professionals trained in compliance standards, tax laws, and international regulations. They follow structured workflows and multi-level quality checks to ensure accuracy.

By choosing to hire offshore tax accountant, firms reduce the risk of calculation mistakes, missing deductions, or incomplete filings, ensuring full compliance with both domestic and international tax requirements.

2. Faster Turnaround Time

Time is critical during tax season or financial reporting deadlines. Offshore teams offer a unique advantage: they can work across different time zones, effectively extending your workday. While your in-house team completes tasks during local hours, an offshore tax accountant can continue processing returns, reconciling accounts, or preparing documents.

This near 24-hour workflow ensures faster turnaround, helping you meet client deadlines and improve satisfaction. Faster processing also allows firms to take on more clients without overburdening internal staff.

3. Cost Efficiency

Maintaining a large in-house team to handle seasonal tax demands or international compliance is expensive. By choosing to hire offshore tax accountant, businesses can access highly skilled professionals at a fraction of the cost of onshore employees.

Cost savings can then be reinvested into technology, staff training, or business expansion. Offshore hiring also eliminates recruitment and infrastructure costs associated with temporary or seasonal staffing.

4. Focus on Strategic Advisory

One of the most valuable benefits of hiring an offshore tax accountant is the ability to free up your in-house team for higher-value work. While offshore professionals handle preparation, reconciliations, and routine compliance tasks, your senior accountants and partners can focus on strategic advisory, business planning, and client relationship management.

This shift allows your firm to move from transactional work to advisory-driven services, which strengthens client trust and increases revenue opportunities.

5. Scalable and Flexible Support

Business needs fluctuate, especially during peak periods like tax season or fiscal year-end. Offshore tax accountants provide scalable solutions, allowing you to increase or reduce support based on current workload without permanent hiring.

Whether it’s handling a surge in tax returns or managing multiple international clients, the flexibility of offshore professionals ensures that your accounting operations remain smooth and efficient.

6. Expertise in Cross-Border Compliance

Global expansion introduces challenges such as international tax laws, transfer pricing regulations, and double taxation issues. Offshore tax accountants are often trained in cross-border compliance, helping firms navigate these complex regulations.

By choosing to hire offshore tax accountant, businesses ensure that international operations are fully compliant, reducing the risk of penalties and audits while optimizing global tax efficiency.

7. Enhanced Technology Integration

Modern offshore tax services use cloud-based platforms, secure data-sharing tools, and workflow management software. This integration allows seamless collaboration between your onshore team and offshore professionals, ensuring smooth communication, version control, and document tracking.

Technology-driven offshore accounting improves accuracy, speeds up turnaround times, and maintains confidentiality, giving your firm a competitive edge in client service.

When Should You Hire an Offshore Tax Accountant?

Offshore tax accountants are suitable for a variety of scenarios:

-

Accounting firms looking to manage busy seasons efficiently

-

Businesses with international operations requiring cross-border compliance

-

Startups and growing enterprises aiming to optimize cash flow

-

Firms expanding advisory services and wanting to focus on strategic planning

If your team struggles with high workloads, missed deadlines, or compliance complexity, it’s the perfect time to consider hiring an offshore tax accountant.

How to Choose the Right Offshore Tax Accountant

To maximize benefits, selecting the right professional is critical. Consider the following:

-

Proven experience with domestic and international tax laws

-

Strong compliance track record and quality control processes

-

Transparent workflows and effective communication

-

Scalable support to match business demands

-

Secure IT infrastructure for data protection

Starting with a small pilot project can help evaluate efficiency, compatibility, and quality before committing long-term.

Conclusion

In an increasingly complex and fast-paced accounting environment, traditional in-house operations may not be sufficient to meet client expectations. Choosing to hire offshore tax accountant offers a strategic advantage — improving accuracy, accelerating turnaround time, reducing operational costs, and allowing internal teams to focus on high-value advisory work.

From managing busy season workloads to navigating international tax regulations, offshore tax accountants provide scalable, flexible, and cost-effective solutions. Firms that embrace this model gain a competitive edge, deliver superior client service, and ensure sustainable growth.

By integrating offshore expertise into your accounting operations, your firm can transform tax preparation and compliance from a stressful, high-pressure process into a streamlined, efficient, and highly accurate system — ready to support your growth goals today and in the future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness